Device manufacturers spend billions each year on designing, marketing, and advertising their products. That’s what they need to do to get you to the counter to buy.

But how many of them are willing to spend the money it takes to ensure that their products hold up after the sale has been made, and to service the product if it breaks?

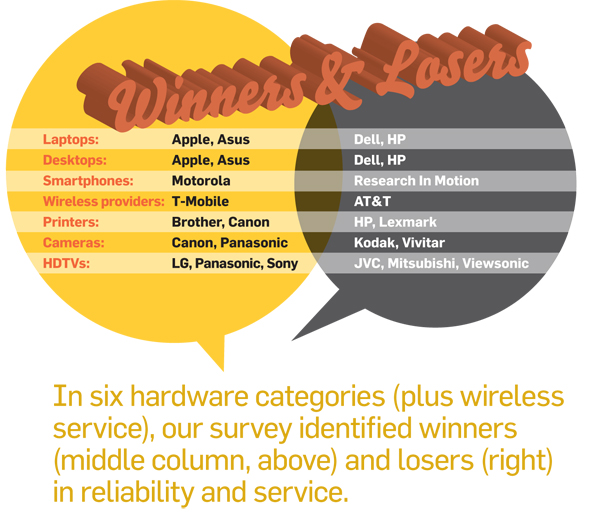

Those are important questions for customers to ask before they buy–and the key questions of our annual Reliability and Service Survey. Each year we survey thousands of our readers to find out which hardware manufacturers have the best–and worst–product reliability and customer service and support.

This year’s response was unprecedented: 79,000 of you rated the tech products you use. With such a large pool of survey data, we learned a great deal about the companies that make laptops, desktops, smartphones, HDTVs, cameras, and printers. Here’s the mile-high view of what we found.

–Put simply, products made by Apple, Asus, Brother, and Canon are typically reliable and well supported.

–Products made by Dell and Hewlett-Packard often aren’t, especially if you’re a home user.

–Laptops are slightly more reliable than before, and have fewer serious problems than desktops.

—Business PC customers are generally more satisfied than their consumer counterparts.

And there’s much, much more.

After you read this article, you may want to jump to our Facebook page, where readers can add their own stories of product reliability and vendor service.

Winners and Losers

Apple once again smoked the competition in the desktop, notebook, and smartphone categories, winning high praise from customers in all reliability and service categories. The Macintosh and iPhone maker did so well that virtually all its scores were above average. Apple’s only average scores were related to the company’s deftness at replacing failed notebook components, and in two areas pertaining to serious problems with the iPhone, the latter perhaps stemming from the iPhone 4’s well-publicized antenna issue that resulted in dropped calls for some users.

Asus did well in ratings among both desktop and laptop owners, though it is best known in North America for its low-cost netbooks. These mini-notebooks have often been the target of derision over the past two years, with critics calling them cheaply made and hard to use. While some netbooks may fit that description, our readers say that Asus portables are, in general, highly reliable.

Canon, which like Apple, is a perennial favorite of PCWorld readers, again rocked the printer and camera categories. It’s not alone at the top, however. In our survey, Panasonic has surpassed Canon in camera reliability, and Brother is gaining popularity among printer users.

Panasonic, the biggest proponent of plasma HDTVs in a market increasingly dominated by LCD models, has a slight edge over LG and Sony. And smartphone users, in addition to praising the iPhone, are particularly happy with Verizon Wireless cell service and with handsets built by HTC. Research In Motion’s BlackBerry phones, however, get low marks for ease of use.

Dell and HP, two of the tech industry’s largest hardware manufacturers, disappointed us this year, particularly in desktops and laptops for home use and (in HP’s case) printers. (We address these two companies’ dismal showings below.)

Overall, it’s clear that many reliability and service problems persist, including defective components that fail out of the box, as well as poorly trained customer service representatives who are incapable of departing from a script.

Golden Apple

Can Apple do no wrong? Indeed, 2010 was a remarkable year for the world’s highest-valued tech company. In addition to unveiling the iPad, a touchscreen tablet that launched a new genre of mobile computing devices, Apple enjoyed record sales and profits. And now it’s won the trifecta by smoking the competition in our reader poll.

IDC computer analyst Bob O’Donnell attributes Apple’s popularity to the company’s stylish, well-made computers and its easy-to-use operating system. “It’s a combination of having high-quality hardware–you pay a premium for it–and a software experience that’s more straightforward,” he says. “And if you have fewer questions, you typically have fewer problems.”

Apple is very good at offering extras too. “You have things like the Genius Bar at all the Apple stores. People literally walk in with their systems, and the [support] guy sits there and says, ‘Oh, yeah, you’ve got to do this, this, and this,'” O’Donnell adds. “It gives you a warm, fuzzy feeling: ‘They’re taking care of me.’ Nobody has anything close to that on the PC side.”

Asus Ascends

The impressive showing by Asus caught our attention as well. This Taiwan-based manufacturer sells an assortment of desktops, such as its all-in-one EeeTop models, and full-size notebooks. But its Eee PC family of mini-notebooks “pioneered the whole netbook concept,” according to ABI Research, and remains the company’s claim to fame, at least in North America.

Our survey doesn’t distinguish between netbooks and laptops, but industry analysts say that any distinction between those categories is irrelevant where reliability is concerned. According to ABI Research analyst Jeff Orr, “Netbooks are made by the same vendors on the same assembly lines as laptop computers. I am not seeing any significant quality differences between netbooks and laptops that use comparable materials. One could argue that lower-cost materials are being substituted, but again this is not being seen.”

Asus shipped 396,000 portable PCs in the United States in the third quarter of 2010, and 201,000 of those were netbooks, according to technology industry research firm IDC. Netbooks may get a bad rap as shoddily built machines, but our survey results suggest this isn’t the case–at least not with Asus gear.

Dell and HP: No More Excuses

Combined, Dell and HP ship nearly half of all PCs sold in the U.S. According to tech industry research firm IDC, HP had just over 24 percent of the American PC market and Dell owned 23 percent in the third quarter of 2010. (Apple and Acer placed a distant third and fourth, each holding 10-plus percent.)

Year after year, readers proclaim HP one of the biggest losers in our Reliability and Service Survey. In 2004, for instance, HP and its Compaq brand were rated last in desktops, and next to last in notebooks and digital cameras. (HP did well that year in printers, however.) The company improved in 2005, earning average grades overall, but then fizzled again in 2007, 2008, and 2009.

Dell’s scorecard has varied over the years, but recent trends are troubling. Its second-to-last laptop ranking in 2009 (only HP did worse) shows a marked decline from 2004 and 2005.

Making Bank on Mediocre?

Interestingly, the perennial grumblings of Dell and HP customers haven’t adversely impacted either company’s bottom line. The assumption may be that because Dell and HP sell PCs at low margins in a tough market, they must minimize spending on support operations; yet HP’s and Dell’s revenue numbers from sales of PCs remain enviable.

Although Dell lost $4 million on its consumer business in the first half of 2010, the company made a total profit of $886 million during that time (that’s 16 percent more than it made in the same period last year). Dell’s lines for small and medium-size businesses accounted for much of its total profits: $636 million, a 34 percent increase from the first half of 2009.

Over at HP, the company’s Personal Systems Group–which includes desktop and notebook PCs, workstations, and handheld devices–saw a year-over-year earnings increase of 18 percent to $1.46 billion for the nine-month period ending July 31, 2010, according to an HP filing with the Securities and Exchange Commission. The company’s Imaging and Printing Group, which sells HP’s home printers, had a 1.66 percent earnings boost to $3.19 billion in the same period.

Meanwhile, several of Dell and HP’s smaller competitors have maintained high survey scores year after year, despite competing in the same cutthroat markets as the Big Two. Asus and Toshiba, which duke it out with Dell and HP in the ultracompetitive Windows laptop market, earned high marks from our readers this year.

That raises the question: If Dell and HP have a profitable business model–one that has enabled them to control half of the U.S. PC market–are they sufficiently motivated to improve their support operations?

They should be. PC and peripheral manufacturers sell in a crowded market, and a customer with an unpleasant support experience is soon a former customer.

HP officials we spoke with expressed surprise at its poor showing in PCWorld’s Reliability and Service Survey. The company has shown improvement recently in similar surveys, they say, including one from the American Customer Satisfaction Index, a University of Michigan business school study based on customer evaluations of the quality of goods and services bought in the United States.

“We’re not happy until all of our customers are happy,” says HP customer service executive Cliff Wagner. “There’s clearly a lot of work that we’re continuing to do, and a lot of investments that we’re doing.”

Those investments include two new customer service and technical support centers in Conway, Arkansas, and Rio Rancho, New Mexico, Wagner says, although both facilities won’t be fully staffed for at least two more years.

“We have not lost our focus on making sure that we’re building customers for life,” adds Jodi Schilling, vice president of HP customer support in North America. “We’re continuing to make investments, not only in the support experience but also in product development.”

If there’s a glimmer of hope for HP, it’s that users who bought machines within the last 12 months were much happier with the company’s support of home desktops and notebooks. (Our one-year chart includes only survey respondents who have bought a PC or printer in the last 12 months.)

It’s possible that HP’s service and support operation devotes more resources to newer customers, resulting in higher satisfaction levels for this group.

Dell’s 12-month results show little change, with home desktops and laptops that aren’t particularly reliable, but with printers that are. Dell business laptops did get higher reliability grades on the one-year chart, but not enough to boost Dell’s standing vis-à-vis the competition.

This year we separated Dell and HP business and home users in the laptop, desktop, and printer categories, in order to compare the satisfaction levels of the vendors’ corporate and consumer customers. For a discussion of the results, see “2010 Reliability and Service: Laptops and Desktops.”

It Takes Only One Frustrating Incident

IDC’s O’Donnell points out that the home market is a challenge to support. But home users aren’t simpletons either, and their frustrations are often born from bad support experiences rather than from self-inflicted slip-ups.

Dan Keller, a medical journalist in Glenside, Pennsylvania, bought an HP Pavilion desktop about three years ago. The CD drive faceplate arrived broken, and HP has yet to replace it, despite his many go-rounds with customer support, he says.

“It wasn’t a run-of-the-mill problem, and they said, ‘That part doesn’t exist,'” Keller says with a laugh. “I said, ‘Well, you’re putting them on computers, they have to exist.'”

Despite the unresolved faceplate issue, Keller’s desktop runs fine. But the frustrating support incident, combined with the poor keyboard layout and other design quirks of an HP laptop he bought recently from Costco (he has since returned it), has soured him on the vendor. “At this point, with two goofy machines, I think I would shy away from HP again,” he says.

Survey Methodology

We surveyed more than 79,000 PCWorld readers who responded to online and print advertisements, as well as e-mail messages, about our survey. With the help of statistical consultant Ferd Britton, we analyzed which companies’ results were reliably above or below the average of all responses pertaining to a certain product type.

It’s important to note that our survey results don’t necessarily represent the opinions of a given company’s customers as a whole. And because our data comes only from PCWorld readers who chose to take the survey, our results don’t necessarily reflect the opinions of PCWorld readers in general.

What the Measures Mean

PCWorld readers rated hardware vendors in six product categories: desktops; notebooks; cameras; HDTVs; printers; and smartphones. Each category (excluding smartphones) had 5 to 9 measurements, each ranking a vendor relative to its competitors. In each measure, we determined whether the vendor’s score was significantly better (s), not significantly different (u), or significantly worse (t) than the average of its peers.

The five reliability measures spotlighted problems with such things as failed components (e.g., a notebook hard drive) or problems that occurred right away or “out of the box.” Among those measurements are two that score our respondents’ overall satisfaction with their vendors’ hardware reliability and customer support.

If a vendor received fewer than 50 responses in a subsection, we discarded the results as statistically insignificant. This threshold prevented us from rating some smaller companies. The measurements in our smartphones category were a bit more comprehensive. We rated smartphone makers using on four reliability measurements and five ease-of-use measurements. For the wireless carriers that sell the smartphones, we measured five different aspects of their customer support, as well as two aspects of their network performance – wireless internet service quality and voice call quality.

Reliability Measures

Problems on arrival (all devices): Based on the percentage of survey respondents who reported any problem with the device out of the box.

Any significant problem (all devices): Based on the percentage of survey respondents who reported any problem at all during the product’s lifetime.

Any failed component replaced (laptop and desktop PCs): Based on the percentage of survey respondents who reported replacing one or more original components because the components had failed.

Core component problem (laptop and desktop PCs): Based on the percentage of survey respondents who reported problems with the processor, motherboard, power supply, hard drive, system memory, or graphics board/chip at any time during the life of their laptop or desktop PC.

Severe problem (HDTVs, phones, cameras, and printers): Based on the percentage of survey respondents who reported a problem that rendered their device impossible to use.

Ease of use (HDTVs, phones, cameras, and printers): Based on the percentage of survey respondents who rated their device as extremely or very easy to use.

Overall satisfaction with reliability (all devices): Based on the owner’s overall satisfaction with the reliability of the device.

Service Measures

Phone hold time: Based on the average time a product’s owners waited on hold to speak to a phone support representative.

Average phone service rating: Based on a cumulative score derived from product owners’ ratings of several aspects of their experience in phoning the company’s technical support service. Among the factors considered were whether the information was easy to understand, and whether the support rep spoke clearly and knowledgeably.

In-person service rating (phones only): Based on a cumulative score derived from phone owners’ ratings of several aspects of technical support received at a service provider’s retail location. Among the factors considered were the ease of getting a representative’s attention in the store, and the knowledge, fairness, and attitude of the rep..

Problem was never resolved: Based on the percentage of survey respondents who said the problem remained after they contacted the company’s support service.

Service experience: Based on a cumulative score derived from product owners’ responses to a series of questions focusing on 11 specific aspects of their experience with the company’s service department.