Lawyers and accountants put the technology available to them to good use last year, especially when it came to real estate issues.

That’s according to the review recently released by Blue J Legal, a Toronto-based producer of artificial intelligence (AI)-powered legal technology, of its first product Tax Foresight.

Released in November 2016, Tax Foresight crunches various pieces of information entered by the user, such as arguments and client details, and predicts how a court would rule based on the information provided.

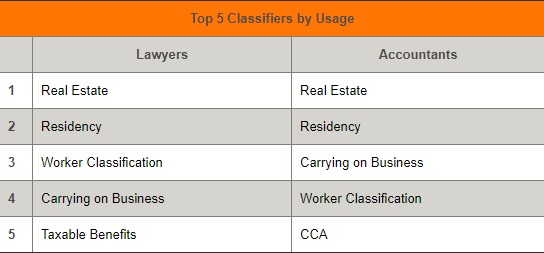

The top five classifiers – issues addressed by Tax Foresight – used by lawyers were real estate, residency, worker classification, carrying on business and taxable benefits.

Source: Blue J Legal

Accountants’ top two classifiers mirrored lawyers’, but were then followed by carrying on business, worker classification and capital cost allowance issues.

This summer, Tax Foresight also launched its Case Finder search engine, allowing users to find case results based on specific search criteria.

The top five searches in Case Finder were for tangible expenditures, worker classifications, real estate, taxable benefits and residency.

Blue J’s recently released second product, Employment Foresight, delivers similar predictive rulings in any area of employment law.

The company has landed several customers over the years including Fasken Martineau, Gowling WLG and Collins Barrow.

There’s only a three to five per cent chance that lawyers will be replaced by intelligent software and AI, according to an April report from the International Bar Association, but the preliminary review of legal documents and the discovery of patterns are well-suited for machines.

The report also points to an intelligent algorithm that went through the European Court of Human Rights’ decisions last year and predicted the outcome of other cases with a 79 per cent accuracy.