“As we continue to see the volume of existing tablets increase, prices naturally come down on component cost,” explains Nick Stam, Nvidia’s director of technical marketing. “You’ll see a number of devices coming out this year that will be lower cost than what you’ve been used to.”

Depending on the device, you might not even have access to Google’s app market or other basic services — and while that approach may work with retailer-backed, limited-use products like Amazon’s Kindle Fire, when it comes to more traditional Android tablets, it doesn’t usually lead to the best user experience.

Related Stories

– Tablets not cannibalizing Canadian PC sales yet

– Tablets beat laptops as top choice of SMBs in U.S.

…

It’s a stark contrast from what you get at the high end of the tablet spectrum, where $500 and up will buy you quad-core processors, a full gigabyte of RAM and eye-popping screens. Even midrange devices, which tend to have last year’s hardware, are capable of delivering decent results. But once you hit that sub-$200 range, it’s like you’ve entered a different dimension — one filled with glorified e-readers and sluggish, subpar slates.

Get ready, though: That dimensional difference is due for a change. A major shift is brewing, and it could bring about the biggest transformation we’ve seen to the tablet class divisions. Put simply, budget-conscious buyers are about to get a lot more bang for their buck.

The tablet class shift

The first signs of the pending tablet class shift showed up in January, at this year’s Consumer Electronics Show in Las Vegas. There, hardware maker Asus showed off a 7-in. tablet powered by Nvidia’s Tegra 3 quad-core processor.

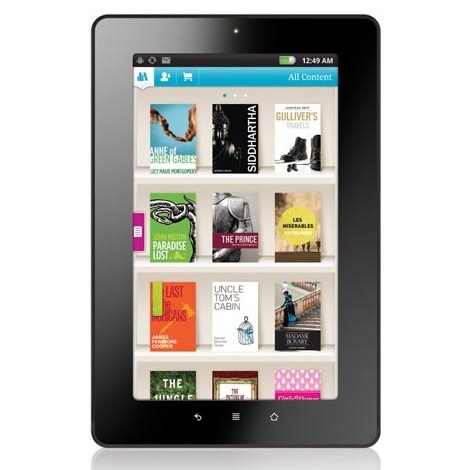

The $199.99 Kobo Vox.

“One size doesn’t fit all,” Nvidia CEO Jen-Hsun Huang declared, citing the need for “different strokes for different folks.”

Asus and Nvidia described a tablet that would run Android 4.0, a.k.a. Ice Cream Sandwich — the latest version of Google’s mobile operating system. An early prototype of the hardware featured a 1280-x-800-resolution IPS display; 1GB of RAM; micro-USB, micro-HDMI and microSD ports; and two cameras, including an 8-megapixel rear-facing lens. Hands-on reviews of the product were glowing: One blog touted the tablet’s “blazing fast” speed, while another talked of its “bright, vibrant screen.”

Perhaps most impressive of all, though, was the tablet’s price tag: $249 — a seemingly impossible cost for a device of that caliber. But this was no mistake.

Asus and Nvidia described a tablet that would run Android 4.0, a.k.a. Ice Cream Sandwich — the latest version of Google’s mobile operating system. An early prototype of the hardware featured a 1280-x-800-resolution IPS display; 1GB of RAM; micro-USB, micro-HDMI and microSD ports; and two cameras, including an 8-megapixel rear-facing lens. Hands-on reviews of the product were glowing: One blog touted the tablet’s “blazing fast” speed, while another talked of its “bright, vibrant screen.”

Indeed, $249 may be only the beginning. Rumors have been rampant that Google is working with Asus on a product similar to the 7-in. tablet introduced at CES, only with a price closer to the $150 to $200 range. Numerous reports suggest the tablet will run a “pure” version of Google’s Android operating system, with no manufacturer modifications, and will be a joint effort between Google and Asus — similar to Google’s work with other hardware manufacturers when creating its Nexus and “Google experience” devices.

While Google representatives won’t comment on rumors and speculation, the evidence is certainly starting to stack up. A quick search of the Internet turns up no shortage of purported leaks and insider winks. Sources close to the situation with whom I’ve spoken have discussed the project with a similar level of certainty, pointing to this June’s Google I/O developers’ conference as the time when the details — and perhaps the product itself — will be unveiled.

In a recent interview with The New York Times, Nvidia’s Huang strongly hinted that an Android tablet running his company’s Tegra 3 processor would debut this summer for a cost of $199. “We took out $150 in build materials, things like expensive memory,” Huang is quoted as saying. “At $199, you can just about buy a tablet at a 7-Eleven.”

The budget tablet strategy

So how are prices on such seemingly high-quality devices suddenly plummeting so low? While Nvidia points to falling component costs, some analysts suspect there’s more at play.

“Companies just aren’t making much of a profit off of these tablets,” says Rhoda Alexander, director of tablet and monitor research for market research firm IHS iSuppli.

Alexander notes the success of Amazon’s $200 Kindle Fire tablet, which — while relatively limited in both performance and capability — has sold exceedingly well. For Amazon, Alexander says, it isn’t about making money off the hardware itself; it’s about making it easy for customers to spend money with the company every day.

“Where they’re making the profit is in the long term of bringing people into the Amazon universe,” Alexander says.

Amazon’s strategy is clearly winning people over: The company accounted for more than half of all global tablet sales in the fourth quarter of 2011, according to IHS iSuppli’s estimates, shipping 3.9 million Kindle Fires and shooting past Samsung to become the world’s second-largest tablet shipper for that quarter.

In the bigger picture, with the help of Amazon’s product — which runs a highly customized, almost unrecognizable version of the Android 2.3 OS — Android’s share of the tablet market is slowly but surely starting to rise. Research by market analysis group IDC (which is owned by International Data Group, the publisher of Computerworld) showed that Android owned 44.6 per cent of worldwide tablet sales in the fourth quarter of 2011 — a 38 per cent jump from its position in the previous term.

Much of that growth came at the cost of Apple. The iPad maker, while still experiencing strong growth, dropped 11 per cent in total market share in 2011 from quarter to quarter, according to IDC, coming in with 54.7 per cent of tablet sales for the final three months of 2011.

The Android tablet challenge

The million-dollar question now is whether Amazon’s model of success can extend to the rest of the Android tablet market, which thus far has struggled to take off. While many analysts predict continued growth for Android overall — Gartner, for example, forecasts Android tablet sales increasing eight-fold over the next five years — some industry experts question whether playing the price game will be enough.

“Lowering the price on Android tablets will help, but that in and of itself won’t sell the products,” contends Sarah Rotman Epps, a senior analyst with Forrester Research.

Epps argues that products like tablets are as much about their interface as their hardware: You buy an Amazon tablet because it provides simple access to Amazon’s content, just like you buy an iPad because it makes it easy to get and use stuff from Apple’s iTunes store. The hardware matters, she says, but it isn’t everything.

“Amazon has been successful because it does a great job delivering on the customer relationship — the transaction,” Epps explains. “A cheaper device from Google doesn’t fix its shortcomings in that area.”

Google may not have reached Apple’s or Amazon’s level of marketplace success, but it’s working to get closer. The company has taken steps toward improving its mobile ecosystem over the past months, integrating its marketplaces for purchasing movies, books, music and mobile apps, and then rebranding it all as “Google Play”. Still, fighting the perception that the Android tablet ecosystem is lackluster may be Google’s greatest challenge in establishing itself as a major tablet player in the months ahead.

“Google has spent more than a decade training consumers to associate its brand with ‘free,’ and now they’re trying to retrain consumers to transact with them,” Epps says. “That’s a hard sell. Part of making Android tablets successful is convincing consumers that Google has a marketplace where they want to do business.”

Low-end tablet competition

One way or another, the lower end of the tablet market seems to be an area where Google thinks it can thrive. In the company’s quarterly investors’ conference call this month, CEO Larry Page acknowledged the success of “lower-priced tablets” using “not-the-full-Google-version of Android” and touched on the company’s plan to pursue that segment of the market further.

“We definitely believe that there’s going to be a lot of success at the lower end of the market … with lower-priced products that will be very significant. It’s definitely an area we think is quite important and that we’re quite focused on,” Page said.

Frequent Google partner Samsung already seems to be on the same page. The company just launched a new 7-inch version of its Galaxy Tab tablet that bears an eye-catching $250 price tag with hardware that exceeds the typical budget-tablet model. With that device and the even more attention-grabbing products on the horizon, we could soon see a change in the very notion of what a “low-end tablet” means.

For makers of existing budget tablets, that may mean being forced to drop even lower in price in order to stay relevant. The logic is simple: If you can buy a quad-core tablet with an impressive display and full Google services for $150 to $200, why would you pay the same cash for a second-rate alternative?

“Wherever the ceiling is set for these new tablets, the budget manufacturers will aim for a yet lower-cost version of that,” IHS iSuppli’s Rhoda Alexander predicts. “They’re playing in a different ballpark and will continue to fill a niche within the market.”

And let’s not forget: Android manufacturers may not be the only players looking to cash in on lower-priced tablets. The always-present rumors of a 7- to 8-in. Apple iPad are picking up steam, with many predicting the advent of a $300 “iPad Mini” before the end of the year.

One thing’s for sure: As more companies move into lower-priced territory and duke it out for market share, it’s the customers who will reap the rewards. After all, in a world where the same dollar seems to buy less with each passing year, getting a better tablet for a lower price is something anyone can appreciate.

JR Raphael is a Computerworld contributing editor and the author of the Android Power blog. You can find him on Google+, Twitter, or Facebook.