-

5 Tech IPOs Gone Wrong

There was a time when Facebook’s IPO seemed bound for success. Starry eyed speculation valued the company at $100 billion long before it ever formulated a stock price. But now that its hit the market, investor appetite seems to have disappeared and the stock is tumbling. That’s resulted in lawsuits from shareholders claiming not all the information was made available ahead of IPO day. But Facebook’s story isn’t unique. There have been several other tech IPOs in recent years that suffered a similar fate, serving as a reminder that investors should always be cautious when treading into tech IPO territory.

-

Facebook (May 18, 2012)

IPO price: $38 IPO day valuation: $90 billion

Current price: $27 Current valuation: $57.7 billion

Facebook was perhaps the most-anticipated tech IPO since Google went public in 2004. Previously estimated by some to be worth $100 billion, Facebook offered shares priced at $38 for its IPO, and trading briefly took it up to $42 on the first day to market. But things went quickly downhill after that and Facebook has now dropped more than $10 per share below its IPO price. A shareholders’ class action lawsuit now claims that Facebook and underwriters Morgan Stanley hid weakened growth forecasts ahead of the IPO. NASDAQ is also being sued relating to the IPO. Facebook investors claim the index mishandled trades, which led to delays in customer orders. The snafu caused problems such as stock price quotes to be unavailable, and some orders were cancelled, the suit claims. Also, shares were expected to start trading at 11 AM, but that was delayed. FB did break volume records for trading on its IPO day.

-

Groupon (Nov. 4, 2011)

IPO price: $20 IPO day valuation: $13 billion

Current price: $10.60 Current valuation: $6.85 billion

After abruptly canceling its IPO in September of 2011, Groupon finally went public in November of the same year with a share price of $20. Initially, the shares continued to be traded above that amount, reaching a peak of $31.14. However, in less than twenty days since its listing, the shares were being traded at almost $4 less than the launch price or about $16 per share.A shareholder lawsuit is being investigated by Kyros & Pressly LLP, asking whether Groupon made false and misleading statements to investors in violation of securities law in connection with the IPO. Groupon didn’t properly disclose negative trends in its business model, the suit claims. On March 30, 2012, Groupon disclosed in a press release that its auditors found a material weakness in its internal controls and that it could not assure the accuracy of its financial statements.

-

SMART Technologies (July 15, 2010)

IPO price: $17.80 IPO day valuation: $600 million

Current price: $1.30 Current valuation: $158 million

SMART is an interactive whiteboard manufacturer based in Toronto that was in the market for 20 years before it went public. The market was fast growing, the story went when this firm was hyped as a star tech stock. But when education spending was slashed, that left no money to invest in fancy classroom projectors.

SMART trades on both the TSX and the NASDAQ, and has been hit by class action lawsuits on both sides of the border. Siskinds announced a class proceeding in the Ontario Superior Court of Justice seeking $100 million, claiming that SMART failed to disclose a significant decline in sales growth and poor performance of a company it had previously acquired. U.S. law firm Brower Piven announced a similar suit in the U.S., as did Gilman and Pastor LLP in January 2011, and several other law firms in various districts.

-

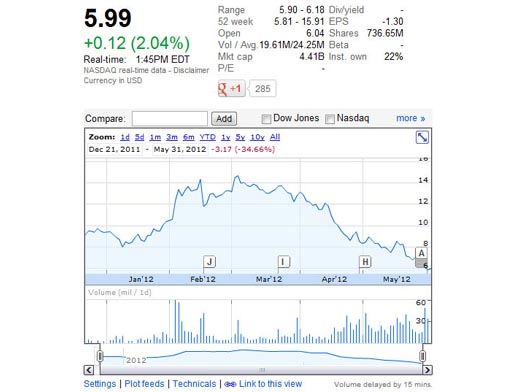

Zynga Game Network (Dec. 16, 2011)

IPO price: $10 IPO day valuation: $7 billion

Current price: $6 Current valuation: $4.4 billion

When Zynga announced its intentions of raising $1 billion by going public in December 2011 at a price of $10 per share, the stock received much attention and investors hoped to make a killing. It was the biggest offering by a U.S. Internet company since Google. However, Zynga shares failed to take flight and fell below the $10 IPO price on the day of listing. Although the share value did manage to claw its way back up to a peak of $14.69 in March of this year, Facebook’s debacle in the market has pulled Zynga shares down to an all time of low of just below $7.

-

Vonage (May 24, 2006)

IPO price: $17 IPO day valuation: $3.9 billion

Current price: $1.79 Current valuation: $405 million

For the uninitiated, Vonage is one of the largest players in the VoIP industry. In May of 2006, Vonage went public with a share price of $17 raising about $530 million. What made Vonage’s IPO unique was that it approached its customers to be the initial investors and offered to sell them the company’s shares. Many of Vonage’s customers accepted and sent in their orders for the company’s shares. Since you’ve gotten this far in the article, you know the story will not take a turn towards sunshine and daisies. Vonage’s shares took a beating on the very first day and dropped almost 13% below the offer price. A class action lawsuit was filed in June 2006 by Atlanta-based firm Mtley Rice, saying the VoIp provider misled investor. The suit claimed the IPO served as an exit strategy for existing investors.